Increasing financial inclusion

Banking on Change with Barclays

Banking on Change with Barclays

Today, more than 2.5 billion people in the developing world are considered financially excluded. This means they do not have access to basic financial services, such as savings, bank accounts or credit.

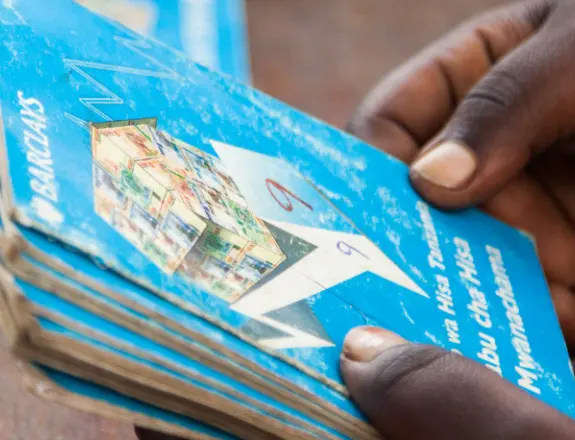

Between 2009 and 2015, Plan International UK worked with Barclays and CARE International as part of the award-winning Banking on Change partnership. The partnership aimed to break the barriers of financial inclusion by setting up community savings groups.

The Banking on Change partnership focused on the additional barriers faced by young people across Africa and India at a time when financial exclusion and youth unemployment are two major issues for the developing world.

Partnership highlights

young people reached with informal financial services

people living on less than £1.25 a day benefitted from financial access

partnership between a global bank and international NGOs

TACKLING FINANCIAL EXCLUSION

OUR ACHIEVEMENTS

During our six years working together with Barclays, the Banking on Change partnership successfully extended basic financial access to over 758,000 people.

Since 2012, Banking on Change’s training was delivered to over 418,000 savings group members improving their ability to save and borrow loans for productive investments and manage their money effectively. Over 100,000 young people received enterprise training, helping them to start income-generating activities to further increase their earnings. In the last three years, more than 116,000 income-generating activities have been established.

Over 310,772 people under the age of 35 have joined a new youth savings group, proving that young people can and want to save. Our pioneering approach to youth groups has helped young people save an average of $69 per year, with savings typically increasing by 31 per cent between the first and second savings cycle. We have seen an increase in young people feeling respected, valued and able to influence community and household decisions.

Banking on Change is the first partnership between a global bank and international NGOs to successfully link informal savings groups to the formal sector - more than 4,400 groups have linked to formal financial institutions since 2013, of which nearly half are linked to Barclays.

Banking on Change has shown that responsible savings-led microfinance works, however financial exclusion is a global problem that requires global solutions. Lessons gained through Banking on Change are now captured in the Youth Savings Group Model which outlines good programming principles for youth savings groups and insight into the role of young people in improving their income, empowerment and standard of living. Our experience of linking groups to formal financial services is captured in Linking for Change Savings Charter, which sets out international principles for effectively and responsibly linking informal groups of savers to formal banking products and services.

I am a business woman

“I borrowed some money from my group and bought 50 chickens, I now have 100 chickens in the poultry house. Next month I aim for 200.

"I want to finish my house, then take my two children to school and maybe next year I can buy my own van to transport the chickens. It has changed my life, I have knowledge through the OSWAE group.

"They teach us how to save the money, how to spend the money. Before I was in the group I was just spending the money anyhow. Now I am in the group I know how to spend the money, I know how to budget the money, I feel proud…yes, I am a business woman.”

- Cleopatra

GET IN TOUCH AND BECOME A PARTNER TODAY

Call us on 020 3217 0260 or email partnerships@plan-uk.org